APA Member Insurance Program

Your patients trust you with their health and wellbeing every day. In your hands they receive the care they need to live their lives to the fullest. In our hands, you receive the protection and support you need to practice at your best. The APA have partnered with BMS to bring you an enhanced member insurance program.

Important information about changes to cover

Every year the APA reviews the insurance cover provided to members, carefully weighing up trends in claim types (i.e. what most members are using and in need of), inevitable increases in costs, and the types of cover and sub-limits included. Decisions are made each year to remove, add, increase and/or decrease certain cover, so it’s important that you consider any changes announced when renewing your membership as to whether you choose an insured membership category or elect for an uninsured category and source your own insurance.

APA’s Member Insurance Program will always ensure you exceed your professional indemnity insurance obligations as required by the Physio Board.

What’s changing in 2025:

From 31 December 2024, the APA Member Insurance (Professional Indemnity and Public & Products Liability (PI&PPL) and APA Entity Insurance will now be supported by AAI Ltd trading as Vero Insurance (Vero), a local insurer with over 180 years of experience providing quality insurance products.

Should you lodge a claim in the first year after this change, Vero will apply the best conditions/limits for your claim, whether that is from your previous policy or current policy. APA Member Insurance (PI&PPL) policy changes

APA Member Insurance (PI&PPL) policy changes

If your membership type includes insurance, please note the below policy changes which have been made to improve your experience by reducing the number of times you need to check in with BMS about your cover:

- Overseas work is now automatically covered with the Policy Territorial Limit now extended to Worldwide cover and the Jurisdictional Limit now extended to Worldwide cover excluding USA.**

- Telehealth is now automatically included for all in scope practices.

**Your policy may still need review by BMS depending on other information you provide to us related to your overseas work.

APA Entity Insurance policy changes

APA Entity Insurance is an additional insurance policy that you may purchase separately. (Find out more about Entity Insurance)

If you take out an APA Entity Insurance policy via BMS, please note the below changes for 2025, which have been made to improve your experience by reducing the number of times you need to check in with BMS about your cover:

- No need to disclose use of pools or gyms

- Overseas work by practice employees is now automatically covered with the Policy Territorial Limit now extended to Worldwide cover and the Jurisdictional Limit now extended to Worldwide cover excluding USA.**

- Telehealth automatically included for in-scope practices

**Your policy may still need review by BMS depending on other information you provide to us related to your overseas work.

Also, if you renew your APA Entity Insurance Policy for 2025, please note that the policy will be renewed for the period 31 December 2024 – 1 December 2025. This change will enable you to renew your policy before the busy festive period in 2025 (premiums will be adjusted according to the shorter insurance period).

Please refer to the Insurance Changes FAQs webpage or read more about the following changes to your cover (PDF).*

Your hands are in good hands

Why choose the APA Member Insurance Program?

The APA member insurance program represents great value for our members and offers a wide range of benefits to meet your professional needs and protect your hard-earned reputation.

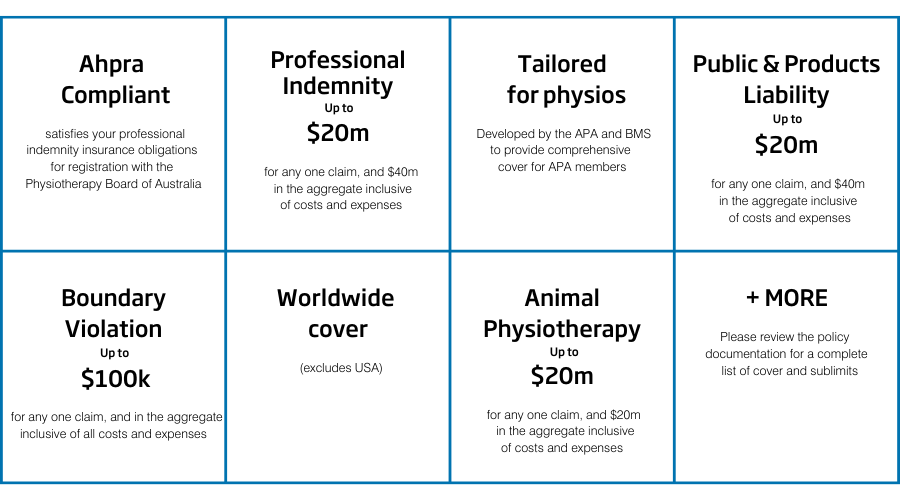

Individual professional indemnity and public and products liability insurance is included in the membership fee for most categories of APA membership, and includes:

- $20,000,000 limit of indemnity per claim for Professional Indemnity, Public and Products Liability

- $100,000 additional cover to support inquiries and investigations relating to allegations of abuse, including sexual misconduct

- Run-off cover when you retire

- Cover for Telehealth (if within your scope of practice)

- Exclusive access to an experienced insurance and claims service and specialist legal support

Download the full policy wording (PDF) for a complete list of cover and sub-limits.

Additional APA Entity Insurance - Information for Practice owners

The individual professional indemnity and public and products liability insurance provides cover for you as an individual. It does not include professional indemnity and public liability insurance for your practice.

It is essential to cover your practice's legal liability to third parties. If a clinician in your business is named in a legal proceeding, it’s common for the practice to also be named as a means of determining liability and fault, if any exists.

Members who require additional insurance to cover their practice, can purchase APA Entity Insurance from APA’s insurance partner, BMS, via the member-only BMS Online Portal. You will need to create an online account with BMS to do this.

If you are a Sole Trader with no employees there is no additional premium payable under the policy you hold through your membership however, you still need to apply for Entity Insurance to obtain a certificate with your practice's business name noted.

Premiums

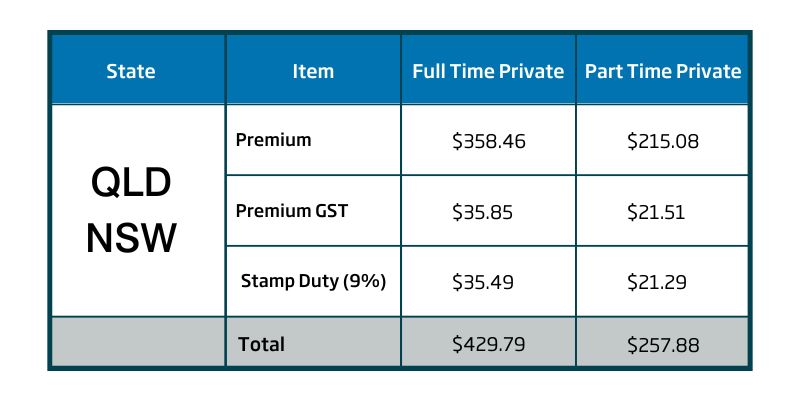

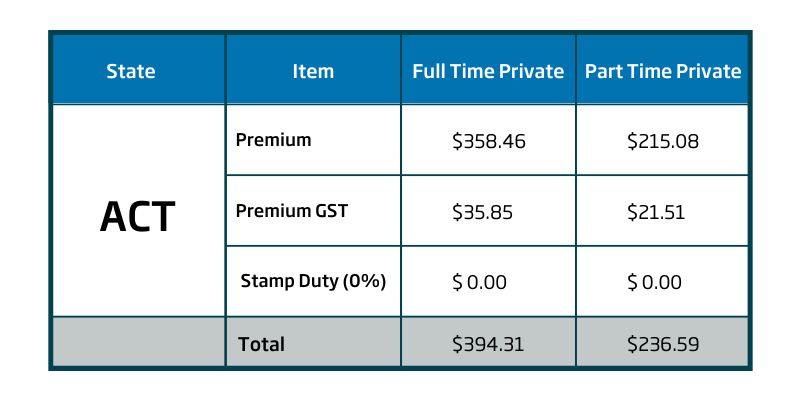

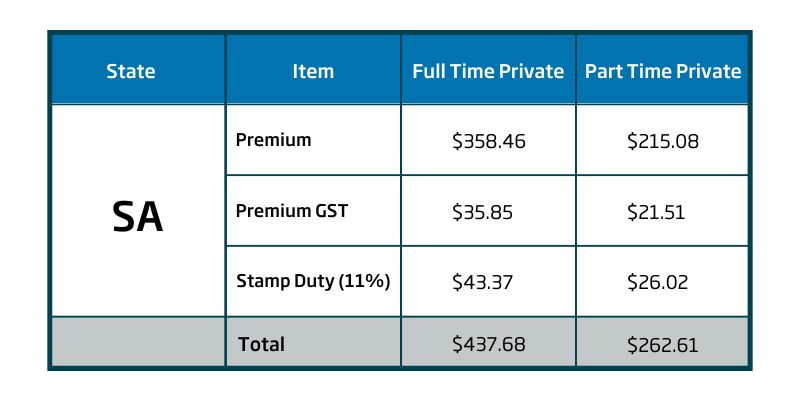

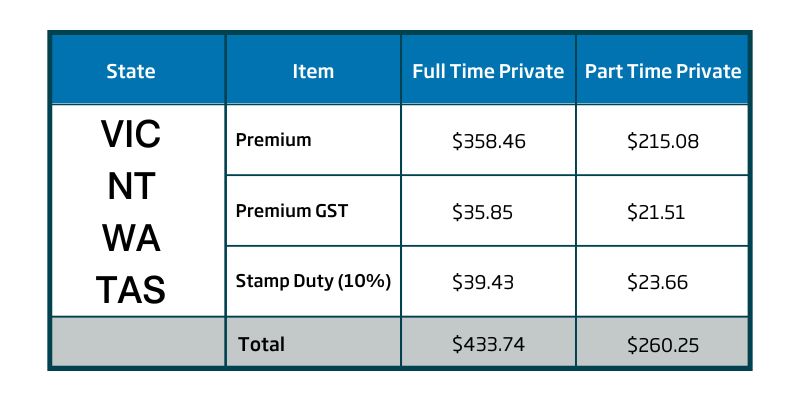

Individual professional indemnity and public and products liability insurance is included in the membership fee for most categories of APA membership. For all insured categories of membership, APA purchases a master policy that provides insurance for members for the coming insurance period. Since members working in private practice can elect either an insured or non-insured membership category, the tables below provide an outline of the insurance premium breakdown by state, including all government fees and charges.

Click on the state where you reside below to view tailored information that is applicable to you.

If you require additional APA Entity Insurance, the premium will be assessed based on your individual practice circumstances and can be obtained via the BMS member-only BMS Online Portal. You will need to create an online account with BMS to do this. If you are a Sole Trader with no employees there is no additional premium payable under the policy you hold through your membership however, you still need to apply for Entity Insurance to obtain a certificate with your practice's business name noted.

Insurance for internationally qualified members

Have you, since 1 January 2023, gained Australian registration as a physiotherapist via the Trans-Tasman Mutual Recognition Agreement (TT-MRA) as a New Zealand Registered Physiotherapist and obtained your New Zealand registration based on Health and Care Professions Council (HCPC) registration in the United Kingdom? If so, you will need to meet at least one of the following additional criteria to be eligible for membership with insurance:

- Complete any of the Australian Physiotherapy Council’s assessment pathways and receive your Final Certificate (or equivalent): or

- Have a minimum of two years’ experience practising as a physiotherapist in Australia, New Zealand or the United Kingdom without any complaints or claims made against you; or

- Have been awarded a physiotherapy degree from any of the following countries:

- Australia

- New Zealand

- United Kingdom

- Ireland

- Canada.

If you have any questions or would like to talk to our Member Support Team, you can email info@australian.physio or call us on 1300 306 622.

Meet BMS

BMS is the official and exclusive insurance partner of the Australian Physiotherapy Association (APA).

BMS is part of the wider BMS group which is dedicated to providing coverage and value-added services to associations and their members. The BMS group provides cover to healthcare and regulated professionals through associations across Australia, Canada, Europe and New Zealand. This experience gives BMS a unique insight and ability to create and deliver significantly enhanced and continuously evolving member-centric insurance programs. This includes ensuring broad, market-leading coverage, evidence-based risk management and exceptional member service.

For any questions about your APA Member Insurance Program, please contact BMS on 1800 931 068 or via email.

Insurance policy documentation

To assist in your enquiry, APA has provided a number of documents. Click on the links below to download your files.

2024-25 APA Member Insurance Policy (PDF)

2023-24 APA Member Insurance Policy (PDF)

2022-23 APA Member Insurance Policy (PDF)

2021-22 APA Member Insurance Policy (PDF)

APA Member Insurance FAQs (PDF)

BMS Terms of Engagement including Financial Services Guide (website)

Not an APA member? Join or renew now

[Disclaimer]

*You must be a current Australian Physiotherapy Association (APA) member to be eligible to register for the APA Member Insurance program. You must be part of the APA Member Insurance program in order to access additional cover. If your membership ceases you will not be offered renewal when your policy expires. In offering this insurance to our members APA is a distributor of BMS Risk Solutions Pty Ltd (BMS) AFSL 461594, ABN 45161187980. The insurance is issued by BMS under authority with the insurer. When acting under this authority BMS acts as agent for the insurer and not as your agent. This is general advice only and BMS has not considered whether it was suitable for your personal circumstances, current objectives, needs or financial situation. Please read the Policy Wording/Product Disclosure Statement and the BMS Terms of Engagement which contains the Financial Services Guide before making a decision about purchasing this policy. There is a Target Market Determination for the Personal Accident policy As a distributor, APA may receive a percentage of the commission paid to BMS by the insurer and/or a fee per policy in offering this insurance to members. APA receives an annual payment from BMS which is used for insurance related marketing and professional development activities to support our members.